The Dollar & The Cost Of Oil (Part III)

Noted: This conversation started here. Then here.

Below is a email from a good friend.

The title of his email to us was "Just The Facts". And then this:

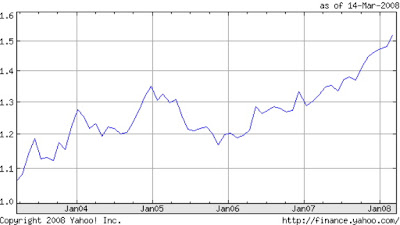

Attached above is the graph of $US versus the EUR for the past 5 years, as well as a graph of the Oklahoma WTI spot price since January 2006. Looking at January 1, 2006, the exchange rate was $1.2/EUR. Today the rate hit about $1.58/Euro, an all-time low.Eat your heart out seven years of pretty foolish Bush Administration fiscal policies.

The oil price today for WTI Cushing is at about $105.86/barrel.

Since Jan 2006, the $US has depreciated by about 31.66% against the euro (1.2 to 1.58), which would equate to a 31.66% increase in the price of oil if they were perfectly correlated. Oil in early January 2006 was at $65/barrel, so the dollar depreciation component would take the price up to approximately $85.58, which is basically a $20/barrel increase. Oil today is at $105, which is another $20/barrel increase. But that means that out of a $40/barrel increase in that period, roughly 50% is attributable to the declining value of the dollar, since global crude markets price all oil in $US. So is your reader correct in suggesting that there are a number of production-related, demand-side (China, etc.) and geopolitical reasons that have contributed to the recent run-up in oil prices? Certainly. But given that oil is a global commodity that is traded in dollars, the declining value of the dollar has necessarily increased the price, and all things being equal, has been responsible for approximately 50% of the overall change in the last two years.